Major Factors Determining Numismatic Value

1. SCARCITY: Numismatic coins are, by their nature, becoming harder to find every day. Therefore their value is likely to increase substantially over time. The number of coins originally issued (mintage) is not always an accurate indication of scarcity. It is the interplay of demand with the remaining supply that determines scarcity. Population reports also help indicate monthly changes in a coin's scarcity or "survival" rate.

2. CONDITION: The condition of a coin is one of the key factors in determining value. The grading of a coin is performed under exacting specifications that require specialized training. The recognized specifications of the grade are a decisive factor in the value of a numismatic coin. Numismatic experts use a numerical scale from 1 to 70 to describe condition, giving the obverse (front) and reverse (back) of each coin equal examination.

3A. SUPPLY: The degree of collector and investor demand plays a key role in determining a coin's value. Rare coins are no longer minted, so the supply is very limited due to: attrition loss, mishandling, donating collections to museums, hoarding, government melt down and government intervention.

3B. DEMAND: A coin's rarity, historical significance, quality and track record can all influence demand for a coin. Coin collectors often build life-long collections with no immediate intention to sell, whereas investors are more concerned with growth and return. Certified coins are placed into a hermetically sealed, tamper-proof plastic holder with its grade and certification permanently displayed.

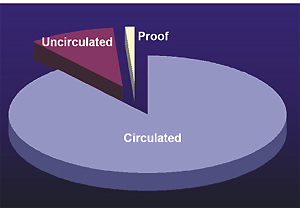

Three major coin categories:

1) Circulated coins: Graded 1-59, hobby level, minimal value

2) Uncirculated coins: Graded "Mint State" 60-70, never used in circulation

3) Proof coins: Graded Proof 60-70, special mintage using polished dies and planchet

The chart below shows an equal $1,000 applied in 1970 into the three asset categories shown. Since then Mint State Numismatic Rare Gold Coins have outperformed the DJIA close to 8 to 1 and gold bullion close to 3 to 1.

Long Term Rare Numismatics Performance

Not All Coins Are Created Equal

In the coin market, price does not automatically equate to value -- such as a car purchase or buying a six pack of Coke. Not all coins are created equal. "Sight-seen" coins are priced differently than "sight-unseen" coins (a coin that is ugly won't sell for the same price as a pretty coin).

I have traded with well over 40,000 clients in the last 30+ years while in the coin business. Here's the bottom line; you get what you pay for. There is no free lunch out there. Don't get me wrong, you may find a similar coin for more or less money, but it won't be the exact same coin.

As you explore further, you'll also find out that the service of the company behind the coin will vary greatly. For example:

- Does that company that you are comparing have a buy back policy behind it?

- Have they been through the ups and downs of the markets?

- Was it a "sight-seen" coin that was inspected by three knowledgeable numismatists, or was it looked at by a person who just started in the coin business?

- Was it one coin of a group of five in which four others were rejected due to copper spots or other distractions that could keep the coin from having optimal market appeal to future buyers?

- Are you truly comparing apples to apples?

A rare coin is not a commodity like sugar, wheat or bullion gold. Have you ever seen a 100 oz. bar of gold? Some are ugly and beat up, some are brand new and shiny, but they both trade for the same value. This is not true in the Numismatic coin market.

The way a coin looks (known as 'eye appeal') as well as the way it was graded is very important when making your comparisons. Frankly, unless the other dealer has the coin you bought right in front of him, he can't make the comparison correctly. He simply can't see the coin through the telephone. Even if you went to his shop, he probably doesn't have another coin to compare it with that is the exact grade or date. Often, coin shops will try and use another date or grade coin, which then invalidates the comparison. My point is that it's easier for many to believe they made a bad trade than it is for them to believe that they bought a great coin at a fair price. We Americans (and I'm guilty too) always believe a bad report a lot easier than we do a good report.

Comparing "Sight-Seen" and "Sight-Unseen" Coins

SightAnother area that can really distort the shopping process is comparing a "sight-seen" priced coin with a "sight-unseen" coin. "Sight-seen" simply means that the buyer has had a chance to view the coin before he or she buys it. "Sight-unseen" prices are the prices that dealers will pay for coins they have never seen and have no ability to return if they don't like the quality or look of the coin.

Simply put, sight-unseen coins are generally bottom-of-the-barrel coins that most reputable dealers reject--or generic coins that are just used to fill orders, without regard for quality. Many newcomers to the market will buy the lower priced coins and hold themselves out as the "real market" on coins. Baloney!

Speak to anyone knowledgeable in coins, and they will tell you to always pay a little more and get the better quality coin. For years David Hall, founder of PCGS, would recommend only MS-65 or better. Why? Simple. He knew that you should always buy the best you can afford. Many times when comparisons are made, dealers are quoting sight-unseen (lowest price) against a sight-seen (highest price)-- making the client think he didn't receive value. When we made the distinction, all of a sudden, the coins are neck-in-neck on pricing.

Also, I have personally seen coins from other dealers being compared to Swiss America coins that were down right ugly. In one instance, a coin offered by another dealer had so many copper spots that it sold for 15% below the current Greysheet price.

Steps Before Buying Coins

Here are some very practical steps that can help you to determine that "the price is right," when buying or selling coins.

Here are some very practical steps that can help you to determine that "the price is right," when buying or selling coins.

1. Always buy from a recognized national dealer or broker who has the experience of the ups and downs in the market. (A dealer with a minimum of a 10-year track record).

2. Be sure the coins can be bought and delivered at the prices quoted. In other words, don't just buy the quote, buy the coin. I can sell coins 10%, 20%, 30%, even 75% less than the other guy IF I don't have them. Make sure the dealer can actually deliver the coin at the price quoted.

3. Buy only sight-seen coins that have an inspection period. Have the option of exchanging the coin if you don't like the way it looks. Also, make sure that the coin you buy has been bought by the dealer on a sight-seen basis and has been inspected for copper spots and other detractions by at least two Numismatists.

4. Be sure the dealer offers you a two-way market. Be sure that the dealer will not only sell you the coin but buy it back. Closely examine the buy-back policy. Make sure the buy-back price does not vary on a basis of quantity. Also inquire on the time factor for repayment. Most reputable companies will settle a trade within 72 hours.

5. Truthful disclosure. Be sure the dealer has presented both the upside and downside risks associated with the coins you are purchasing. Short-term versus long-term positioning should be explained and understood.

6. Buy from a dealer that you have complete trust in. Check references. Most importantly, ask a many questions and get satisfying answers. Get facts, not hype. -Craig R Smith CEO Swiss America

More Questions?

Call (877) 703-2193. We will answer any questions you may have.